Introduction to Business Finance for SMEs

Understanding business finance is crucial for the success of small and medium enterprises (SMEs). It’s all about managing your money wisely and making smart choices on borrowing and generating cash flow. Think of it as the fuel that keeps your business running. Without proper finance management, it’s tough to cover daily expenses, expand your business, or survive tough times.

There are several options for SMEs to manage their finances, from traditional loans to more innovative alternatives like crowdfunding and merchant cash advances. Each option has its benefits, depending on your business needs and goals. So, it’s important to get a grip on the basics of business finance. This will help you navigate the options available to secure the funding your business needs to thrive.

Remember, understanding your financial options is the first step to making informed decisions that support your business’s growth.

Understanding SME Borrowing Options

Small and medium enterprises (SMEs) often need extra cash to grow, but navigating borrowing options can feel like a maze. Let’s break it down.

Overdrafts are provided by your bank as part of your current account, and are readily available but often high cost credit for short term usage

Term loans provide a structured repayment plan for borrowers, allowing them to repay the loan over a set period, often several years. This is what was traditionally known as a bank loan.

A Revolving credit facility allows borrowers to repeatedly borrow up to a predetermined credit limit and repay it over time.

Invoice finance provides flexibility, allowing businesses to borrow against outstanding invoices and pay fees based on the financing amount used.

Asset finance is perfect for buying new machinery or tech, using the purchase itself as collateral.

Then, there’s merchant cash advances, where lenders give cash in exchange for a portion of future sales.

And don’t overlook peer-to-peer lending, a relatively more recent way to get cash through online platforms connecting borrowers with individual lenders.

Each option has its pros and cons, based on how fast you need the money, repayment terms, and interest rates. Choose wisely to keep your business thriving.

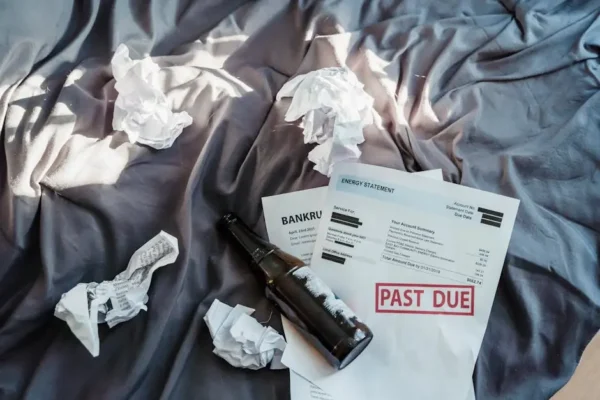

The Basics of Cash Flow Management

Understanding cash flow is crucial for SMEs. It’s the lifeblood of your business. It’s not just about the money coming in and going out, but managing it effectively to keep your business healthy and running. Here’s a simple breakdown:

- Know your numbers: Always be aware of your current cash position. This means knowing exactly how much money is coming in and going out of your business.

- Plan ahead: Anticipate future cash inflows and outflows. This could involve mapping out when you expect to receive payments from customers and when your own bills are due.

- Build a safety net: It’s wise to have a buffer of cash to handle unexpected expenses or downturns in revenue. This helps you avoid panic when things don’t go as planned.

- Cut unnecessary costs: Regularly review your expenses and cut down on anything that isn’t essential to your operations or generating revenue.

- Invoicing discipline: Send out invoices promptly and follow up on late payments. Delayed receivables can significantly strain your cash flow.

Remember, managing cash flow isn’t about having a huge amount of money at your disposal but about ensuring you have enough cash to cover your obligations at any given time.

By staying on top of your cash flow, you can make informed decisions, invest in growth opportunities, and navigate through challenging times more effectively.

Short-term vs. Long-term Borrowing

When it comes to borrowing, SMEs need to think about time — specifically, whether to go for short-term or long-term loans.

Short-term borrowing usually covers periods less than a year. This could be for managing cash flow, handling unexpected expenses, or bridging a temporary funding gap.

The beauty of short-term loans is their quick turnaround. You get the funds fast, and you pay it off quickly, so it’s less of a burden on your books. Examples include overdrafts or merchant cash advances (MCAs). However, they often come with higher interest rates.

Long-term borrowing, on the other hand, stretches out for years, sometimes even 30 in the case of large acquisitions and the right conditions. These loans are for big, strategic moves like buying new equipment, expanding operations, or refinancing old debt. They have lower monthly payments, which is easier on your monthly cash flow, but remember, you’ll be paying interest for a longer time.

Each business’s needs are different, so weigh the pros and cons carefully. Short-term might fix an immediate problem, but long-term loans could fuel your business’s growth engine for years to come.

Grants and Government Support for SMEs

Governments often lend a hand to SMEs because they know these businesses are crucial for the economy. There’s a variety of grants and support options available, aiming to boost innovation, employment, and growth within the SME sector. These aren’t loans, so you won’t need to pay them back, which is a big deal. However, they do come with conditions and are usually targeted at specific industries or projects that aim to achieve a broader economic or social goal.

Applying for these grants might feel like a marathon sometimes, with loads of paperwork and stiff competition. But the payoff can be worth the effort. You can get financial support to help with research and development, expanding your business, or even hiring new staff. Each country, county, or city might have its own set of programs, so it’s essential to check what’s available in your area and if you qualify.

How do you get this support? Start by visiting government websites focused on business and economic development. These platforms are gold mines for information on grants, eligibility criteria, application deadlines, and how to apply. Don’t overlook local business associations, as they can provide guidance and even insider tips on navigating the application process.

Remember, staying informed and proactive can open doors to invaluable resources that bolster your business’s growth and stability without dipping into your cash flow.

Bank Loans: Pros and Cons

Bank loans are a go-to for many SMEs needing cash. The good? They offer structured repayments, potential tax benefits, and usually, a decent interest rate. You get a lump sum to boost your business, improving cash flow or funding new projects. But, bank loans aren’t all sunshine.

The not-so-good includes a rigorous application process with lots of paperwork. Your business must show creditworthiness, and sometimes, you have to provide collateral – assets like equipment or real estate that the bank can take if you don’t pay back the loan. Plus, the fixed monthly payments can be heavy on your cash flow, especially if your business hits a rough patch. In short, while bank loans can be a solid option for funding, weighing their pros and cons carefully is crucial.

With traditional banks more recently reducing the amount of finance they provide to SMEs, this is becoming a less viable option for a lot of businesses that aren’t established or very low risk.

Alternative Financing Options for SMEs

Exploring financing for your business isn’t just about heading to the nearest bank anymore. There’s a world of alternative financing options out there. These paths can offer more flexibility and sometimes, even better terms. Let’s break them down.

First off, there’s crowdfunding. Sites like Kickstarter or Indiegogo let you pitch your business idea to the world. If people like it, they’ll pledge money to help you get started. This isn’t a loan; you’re not expected to pay this money back. However, you might offer perks or products in return for support.

Fintech companies such as iwoca, Funding Circle, and Capital on Tap offer a range of products that are often similar in structure to traditional bank offerings but can often better assess risk and serve more businesses as a result.

Peer-to-peer lending is another avenue. Through online platforms, you can borrow directly from individuals instead of banks. This can mean quicker access to funds and potentially lower interest rates. But, as with any loan, you’ll need to pay this money back with interest.

Lastly, consider merchant cash advances. If you make a lot of sales through credit card transactions, this option allows you to borrow against future sales. You get cash upfront, and the lender takes a percentage of your daily credit card income until the debt is paid. It’s fast but can be more expensive than traditional loans.

Each of these options has its own set of pros and cons. Weighing them carefully against what your SME needs is critical in making the right financing choice.

Improving Cash Flow without Borrowing

Improving your cash flow without borrowing money might seem tough, but it’s entirely possible with some smart strategies.

First off, get quicker at invoicing. Send those bills the moment a job’s done or a product’s sold. This pushes your cash flow in the right direction faster.

Next, take a hard look at your expenses. Every business has at least one area where they can cut costs without hurting their operation. Sometimes, it’s as simple as switching suppliers or going for less fancy office supplies.

Another powerful move is offering discounts for early payments from customers. It might sting a bit to get a little less money, but getting it faster can keep your cash flowing smoothly.

Also, inventory management can be a game-changer. Too much stock ties up your cash, so adjust inventory levels to match your sales better.

Lastly, embrace technology. Online payment platforms can speed up the time it takes for your money to move from your customer’s pocket into yours. Each of these steps can make a big difference in your cash flow without the need to borrow a dime.

Key Considerations Before Applying for Finance

Before you jump into applying for finance to boost your business, there’s some groundwork to do. First, ask yourself why you need the cash. Is it for expansion, inventory, or perhaps to smooth out cash flow gaps? Knowing the purpose will guide you in choosing the right finance option.

Next, assess your repayment capability. Scrutinize your business cash flows and projections. Can your business handle the additional repayments without stressing your operations? Don’t shy away from discussing this with a financial advisor. It’s crucial to understand the total cost of borrowing, not just the interest rate or the monthly payments. Look for fees, charges, and any penalties for early repayment.

Also, consider the term of the finance. Longer terms might reduce your monthly outgo but increase the total interest paid. Lastly, prepare your paperwork. Lenders will likely ask for business plans, financial statements, and cash flow forecasts. The clearer your documents, the smoother the application process.

Keep these considerations in mind, and you’re better positioned to choose a finance option that suits your SME’s needs and capabilities.

Conclusion: Choosing the Right Finance Option

Picking the right finance option for your business boils down to two key points: knowing your needs and understanding what’s out there. It’s not just about grabbing any loan that comes your way.

Some loans are better for handling cash flow issues; others can help you expand or invest in new equipment. Interest rates, repayment terms, and eligibility criteria can vary a lot. So, dig deep. Look at what each option offers and weigh them against what you aim to achieve with that extra cash.

And remember, it’s always smart to talk things over with a financial advisor. They can offer insights and guidance tailored to your specific situation, helping you make a choice that aligns with both your immediate and long-term goals.

It’s about making informed decisions that propel your business forward without dragging it down with unsuitable debt.