Introduction: Understanding Interest Rates and UK Businesses

Interest rates are the cost of borrowing money. Think of it as the price tag that banks and lenders put on the money they lend you. For businesses in the UK, especially in 2024, understanding how these rates work is crucial. Why? Because higher interest rates mean the business must pay more to get the same amount of money. It’s like the difference between buying something on sale and paying full price.

When rates are low, it’s cheaper for businesses to borrow money to grow, invest in new projects, or manage day-to-day operations. But when rates go up, the cost of borrowing spikes. This can slow down expansions, reduce profits, and make it harder for businesses to pay back their loans.

In a nutshell, higher interest rates in 2024 could mean a tighter belt for many UK businesses. The key takeaway here? Interest rates matter—a lot—to the health and growth of businesses.

The Mechanism of Interest Rates in the UK Economy

Interest rates in the UK economy are like the pulse of the financial system, set by the Bank of England. They serve as a primary tool for controlling inflation and stimulating or cooling down the economy. When the Bank of England raises interest rates, it’s essentially making it more expensive to borrow money. This is a double-edged sword.

For businesses, higher interest rates mean the cost to borrow money for things like expansion, equipment, or refinancing existing loans goes up. This can lead to businesses slowing down their investment or passing on the higher costs to consumers through raised prices on goods and services. On the flip side, savers benefit as they get more return on their savings. This entire mechanism is a balancing act, aimed to keep the economy growing without letting inflation spiral out of control.

So, when we talk about higher interest rates in 2024, we’re looking at a scenario where borrowing money is no longer as cheap, potentially tightening the belts of UK businesses, affecting their growth and pricing strategies.

Historical Perspective: Interest Rates and Business Borrowing Costs

Higher interest rates often lead to increased borrowing costs for businesses. This isn’t a new trend; it’s been a fact for decades. Historically, when the Bank of England raises interest rates, the cost for a business to borrow money from banks also goes up. Banks need to make a profit, so they charge businesses more for loans. It’s as simple as that.

Higher interest rates also mean businesses have to pay more over the life of a loan, which can reduce profits and cash flow.

This has been a pattern observed during various economic cycles in the UK, impacting how businesses invest and grow. If you look back, during times of high interest rates, businesses often scale back on expansion and hiring plans due to the increased cost of borrowing. When interest rates go up, it directly affects how much it costs for businesses to borrow money, influencing their operations and growth prospects.

Projected Interest Rates in 2024 and their Economic Implications

In 2024, UK businesses might face higher borrowing costs due to slower than anticipated reducing in interest rates. This trend could significantly affect their operations and financial planning. When interest rates go up, businesses find it more expensive to borrow money. This can lead to a drop in investment and expansion efforts because the cost of financing new projects or refinancing existing debt becomes too steep. Higher rates generally mean higher repayments on loans, squeezing company budgets.

But why have rates increased? The Bank of England raises rates to control inflation, ensuring that the economy doesn’t overheat. While this is good for keeping prices stable, it creates a challenging environment for businesses that rely on loans for growth.

The economic implications are broad. On one hand, this could cool down overheated sectors and reduce the risk of a bubble. On the other, it could slow economic growth if businesses cut back on investment due to increased financial strain.

Moreover, sectors with high levels of debt or those more sensitive to interest rate changes, such as construction and manufacturing, might feel the impact more acutely. Companies in these sectors should prepare by evaluating their debt levels and considering fixed-rate loans to mitigate the risk of rising rates.

UK businesses are on the cusp of a potentially challenging period in 2024 with the projection of higher interest rates. Careful financial planning and strategy adjustments will be crucial for navigating this landscape.

Immediate Effects of Higher Interest Rates on UK Business Loans

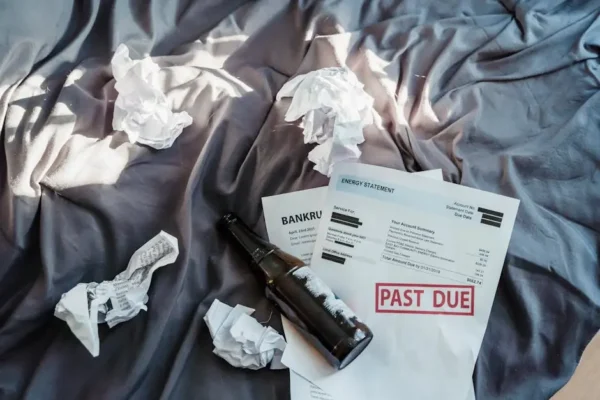

When interest rates go up, it directly hits UK businesses looking for loans. Suddenly, borrowing becomes more expensive.

Higher interest rates mean the cost of getting a loan from banks climbs. For businesses, especially small ones, this can be a punch to the wallet.

The immediate effect? Every pound borrowed now comes with a bigger chunk of interest to pay back.

This makes businesses think twice about borrowing for expansion or equipment.

Some might cut back on spending or delay projects, which slows down growth. It’s not just about the higher repayments.

The mood changes. Investors get cautious, and customers might tighten their belts, expecting prices to rise.

In short, the domino effect starts with higher interest rates and can ripple through the entire economy, making life a bit tougher for UK businesses trying to grow or just keep the lights on in 2024.

Long-term Impact on the Cost of Borrowing for UK Businesses

Higher rates mean businesses have to pay more on any new loans they take out, which can slow down expansion plans. Over the long term, this can add up, making it tougher for businesses to grow and potentially leading to a slowdown in the overall economy. If a business has existing loans that are due for renewal, the new rates will apply, possibly increasing their operational costs.

This doesn’t just hit the big players; small and medium-sized enterprises (SMEs), which are often seen as the backbone of the UK economy, tend to feel this even more. They may find it harder to manage cash flow or invest in new projects.

Additionally, for businesses looking to start up or expand, the hurdle of higher borrowing costs could limit their ability to get off the ground or grow. On a sector level, industries that rely heavily on borrowing, like construction and manufacturing, might see a slowdown in their projects, which can have ripple effects on employment and service prices.

So, while the bump in interest rates aims to manage inflation, it’s a double-edged sword for businesses, affecting everything from day-to-day operations to long-term strategic planning.

Strategies for UK Businesses to Mitigate Increased Borrowing Costs

UK businesses are facing higher interest rates, which means borrowing money is getting more expensive. But don’t worry; there are strategies you can use to soften the blow.

First, consider locking in interest rates now if you have loans or are planning to borrow. This can protect you from future rate hikes.

Another smart move is to tighten your belt. Look at your expenses and cut back where you can to free up extra cash for interest payments.

Also, it’s a good time to review your debt. See if you can consolidate high-interest loans into one with a lower rate. Exploring alternative funding sources like venture capital or government grants might also be a wise path.

Plus, maintain a good relationship with your bank. Sometimes, simply having a strong banking relationship can lead to better loan terms.

Lastly, keep an eye on the market. By staying informed, you can anticipate changes and adjust your strategies accordingly.

These steps won’t make the challenge disappear, but they can help you navigate through higher interest rates with less stress.

The Role of Government and Financial Institutions during Rising Interest Rates

The government and financial institutions play a critical role in managing the impact of rates on the economy and, specifically, on small and medium-sized enterprises (SMEs). The government may introduce policies to support businesses, such as offering tax reliefs or subsidies to reduce the financial strain.

Additionally, they can launch grant schemes or low-interest loan programs to provide more affordable financing options. Financial institutions, on their side, sometimes adjust their lending policies. They might offer longer loan terms or more flexible repayment plans to help businesses cope with the increased costs. Some banks may also create special lending programs directly aimed at SMEs, encouraging them to keep investing and growing, even when the borrowing rates are less favourable.

Remember, while higher interest rates make borrowing more expensive, the government and financial institutions take steps to soften the blow for UK businesses, helping them adjust and continue to thrive.

Conclusion: Preparing for the Future of UK Business Financing

High interest rates change the game for UK businesses looking to borrow in 2023⁄24. With rates going up, loans become more expensive. Monthly repayments rose and the total amount paid back over time increased.

It’s a double whammy – tougher to get affordable financing and more costly to manage debt.

Smart businesses are already looking ahead, scouting for fixed-rate loan options to lock in current rates before they climb further. Others are trimming down debt, aiming to improve cash flow and reduce reliance on borrowed money.

Diversifying income sources and cutting unnecessary expenses are also top strategies. The goal? Stay nimble, reduce financial risk, and secure a competitive edge despite rising costs of borrowing.

In essence, preparing for and living with higher interest rates in 2024 isn’t just about bracing for the impact, it’s about proactively adjusting strategies to ensure that when the tide rises and falls, your business isn’t just surviving; it’s set to thrive.