Securing funding is a critical step for any small business aiming to grow and thrive. In this guide, we’ll explore various funding options available to small businesses and provide tips on how to successfully obtain the financial support you need.

Identify Your Funding Needs

Before seeking funding, it’s important to clearly identify why you need it and how much you’ll need. This will guide your choice of funding options and help you create a persuasive pitch.

Start by outlining the specific purposes for which you need funding. Whether it’s for expanding your operations, purchasing new equipment, or boosting your marketing efforts, having a clear understanding will not only help you target the right funding sources but also prepare a compelling case for your request.

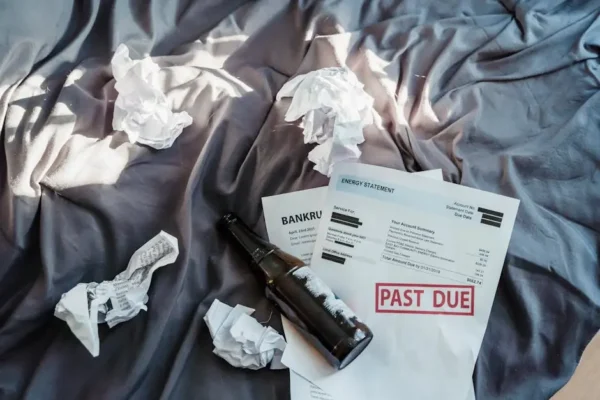

Additionally, consider both your short-term and long-term needs. While securing sufficient funds to cover immediate expenses is vital, planning for future growth ensures you don’t end up in a financial pinch later. Detailed financial planning and projections can be extremely helpful in this process.

Lastly, document any operational efficiencies or cost-saving measures already implemented. Demonstrating prudent financial management can significantly enhance credibility with potential funders.

Explore Different Funding Options

There are various funding sources available, including loans, grants, angel investors, venture capital, and crowdfunding. Each has its own set of advantages and requirements, so it’s essential to choose the one that best fits your business needs.

Traditional bank loans are a common option but often require a solid credit history and collateral. They offer structured repayments and potential tax benefits but might involve a time-consuming application process. For a breakdown of traditional financial products, check our detailed guide on Lending and Credit Options Available to UK Companies.

Grants offer another promising option, especially if your business fits within the criteria set by the granting organization. While they don’t require repayment, they are often highly competitive and may come with stringent conditions.

Angel investors and venture capitalists provide equity financing. In exchange for funding, they take an ownership stake in your business. This can be beneficial, as they often bring valuable expertise and connections, but be prepared to share control and profits. Understanding trends in the UK startup scene can provide valuable insights, as explored in our article on Raising debt and equity for your business.

Crowdfunding has gained popularity as it allows you to raise smaller amounts from a larger number of people through platforms like Kickstarter. This not only funds your project but can also serve as a marketing tool.

Lastly, don’t overlook alternative options such as merchant cash advances, peer-to-peer lending, and fintech solutions. These can provide quicker access to funds but often come with higher costs.

Prepare a Strong Business Plan

A well-structured business plan is key to convincing potential funders of your business’s viability and potential for growth. Make sure your plan includes detailed financial projections, market analysis, and clear objectives.

Begin with an executive summary that clearly states your business goals and how the funding will help you achieve them. This is often the first section investors will read, so make it compelling and concise.

Your business plan should also include a comprehensive market analysis that demonstrates your understanding of the industry, target market, and competition. Highlight any unique selling points and competitive advantages your business has.

Detailed financial projections are crucial. This includes profit and loss statements, cash flow forecasts, and balance sheets. Providing realistic and well-supported numbers will help build confidence in your business’s financial health.

Break down how the funds will be used and provide a timeline of key milestones. Clear, achievable objectives show that you have a strategic plan to grow the business and make the best use of the funding.

Build a Solid Pitch

Your pitch should succinctly convey your business idea, the problem it solves, and the potential return on investment. Practice your pitch to ensure you can deliver it confidently and clearly.

Start with a strong hook that grabs attention. This could be an interesting statistic, a personal story, or a bold statement about your market opportunity.

Clearly outline the problem your business addresses and present your unique solution. Highlight what sets your business apart from competitors and why it’s likely to succeed.

Investors want to see a path to profitability. Outline your business model, revenue streams, and financial projections. Make sure to highlight any early successes, such as customer testimonials or growth metrics.

Finally, prepare for questions. Anticipate potential concerns and have thorough answers ready. Practicing with a mentor or advisor can be incredibly beneficial in refining your pitch.

Network with Potential Investors

Networking can open doors to funding opportunities. Attend industry events, join business groups, and connect with potential investors through social media and networking platforms.

Building relationships in your industry can be invaluable. Attend conferences, seminars, and trade shows where investors are likely to be present. These events offer a great opportunity to showcase your business and make valuable connections.

Online platforms such as LinkedIn are also essential. Join relevant groups and participate in discussions to build your professional network. Share insights and updates about your business to keep potential investors engaged.

Consider joining a business incubator or accelerator program. These programs often provide funding opportunities as well as mentorship, resources, and networking with other startup founders and investors.

Engagement within the community counts for a lot. Regularly share your business successes, milestones, and insights on social media to keep your network informed and invested in your journey.

Consider Alternative Funding Sources

If traditional funding sources are not an option, consider alternatives such as bootstrapping, business incubators, or strategic partnerships. These can provide the funding and resources needed to grow your business.

Bootstrapping, or using your own savings and revenue to fund your business, can be a viable option if external funding is difficult to secure. Although it may slow your growth, it allows you to retain full control of your business.

Business incubators and accelerators offer more than just funding; they provide mentorship, office space, and various resources designed to help startups grow. These programs often culminate in a demo day where you can pitch to a room full of investors.

Strategic partnerships with larger companies can also be a source of funding and growth. Look for companies in your industry that could benefit from your product or service and propose a mutually beneficial partnership.

Additionally, don’t overlook the potential of revenue-based financing. This method allows you to repay the investment as a percentage of your revenue. It can be particularly useful for businesses with consistent sales but who want to avoid the constraints of traditional loans.

Final Thoughts

Securing funding for your small business is indeed a challenging yet achievable goal. By understanding your options and preparing thoroughly, you can navigate the funding process successfully and take your business to new heights. For more insights into financing trends and expert strategies, don’t miss our comprehensive guide on Understanding Cash Flow: The Key to Business Survival and Growth.