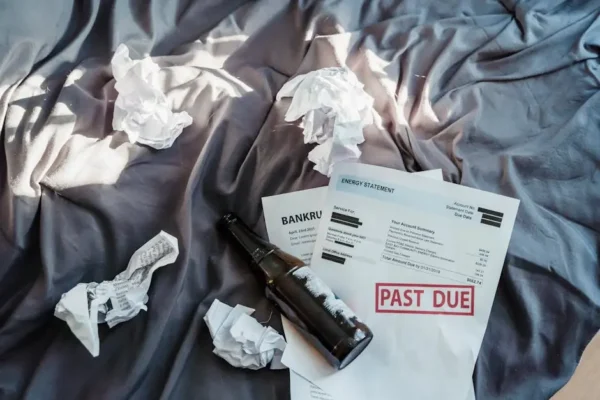

In today’s business landscape, managing outstanding debts can be a significant challenge for companies of all sizes. Turning to commercial debt recovery services is an option many businesses consider. But are these services truly worth the investment? Let’s explore their benefits, potential drawbacks, and factors to consider before making a decision.

What Are Commercial Debt Recovery Services?

Commercial debt recovery services are specialized firms that assist businesses in collecting overdue payments from clients or other businesses. These services often employ a range of strategies, from negotiation to legal actions, to ensure payments are made. Essentially, they take over the burden of dealing with delinquent debtors, allowing businesses to focus on their core functions without the distraction and stress of outstanding debts.

Companies might find themselves strapped for time and resources when it comes to pursuing unpaid debts, particularly if they lack a robust accounts receivable department. This is where commercial debt recovery services come in handy. With expertise and a track record in effective collection strategies, they step in as the experts handling what can often be complex and time-consuming processes.

By understanding the legal aspects of debt recovery and the frameworks within different jurisdictions, these services provide a structured approach to debt collection. This not only maximizes the chances of recovery but also ensures compliance with all applicable laws, safeguarding the business’s reputation.

Benefits of Using Commercial Debt Recovery Services

Utilizing these services can save time, reduce stress, and significantly increase the likelihood of recovering owed money. Professional firms bring experience and tools specifically tailored for successful debt recovery, often achieving better results than in-house teams might. By outsourcing this function, businesses can rest assured that their outstanding debts are in capable hands.

Efficiency is another major advantage. Thanks to their specialized skills and streamlined processes, debt recovery agencies often resolve cases faster than internal teams. They can apply pressure efficiently and legally, making use of tactics that may include direct negotiation or liaising with legal representation where necessary.

Moreover, these services allow businesses to maintain focus on growth opportunities rather than becoming stuck in resource-draining disputes over unpaid invoices. Their expertise extends to understanding various debtor behaviors and tailoring strategies to an individual case, which can be particularly beneficial in complex situations.

Potential Drawbacks to Consider

While there are many benefits, it’s important to consider potential downsides, such as cost and the impact on client relationships, which can sometimes be strained by aggressive debt recovery tactics. Some recovery services might employ relentless strategies that, while effective, could lead to negative perceptions from clients.

There is also the financial cost to think about. Debt recovery services typically charge a commission on the funds they collect, or they might require upfront fees. Businesses should weigh these costs against the potential recovery to ensure a net gain in terms of cash flow improvement.

Additionally, loss of control is a factor. Entrusting an external agency means handing over a part of your business operations and being comfortable with their methods and practices. This necessitates finding a provider whose values align with your company’s ethos and client relationship goals. Balancing these factors is key in determining whether the investment in such services is justified.

When Should You Consider Hiring a Service?

Businesses facing frequent overdue payments or lacking internal resources to handle debt collection might find these services particularly beneficial. Assessing the scale of your debt issues is critical in making a decision. For some, hiring a debt recovery service might be a last resort, while for others, it could be an ongoing strategy integrated into their financial management processes.

One indicator that it might be time to engage a debt recovery service is when internal efforts consistently result in low recovery success or strained client relations. If your team is overwhelmed and your cash flow is suffering as a result, outsourcing this function could provide a practical solution and financial boost.

It is also advantageous to adopt strategies for successful debt recovery early in the process to minimise losses. When internal processes have proved ineffective, and debts are mounting beyond manageable levels, it’s wise to consult professionals equipped with industry-specific insights and the expertise necessary to handle complex scenarios.

Key Factors to Evaluate Before Making a Decision

Evaluate the cost of services versus the amount of debt recoverable, the reputation of the service provider, and how their approach aligns with your company’s values. Opt for providers that offer transparency about their methods and outcomes.

Take into account the relationship dynamics between your business and its debtors. How a service provider’s approach to resolution aligns with your customer relationship strategy can drastically affect your long-term business prospects. A balanced debt recovery approach that prioritizes cooperation and fairness while maintaining efficacy, as described here, should be considered.

Finally, consider what might work best for your situation—a full-service agency or a one-off solution. Depending on your needs, some customization might be necessary to attain the most advantageous arrangement. With proper evaluation and personalized solution implementation, commercial debt recovery services can be a profoundly impactful tool for businesses.

Making the Right Choice for Your Business

Ultimately, commercial debt recovery services can offer significant benefits, notably in terms of time savings and professional expertise. However, the decision to employ these services should be balanced with considerations about cost and company relationships. By weighing the pros and cons carefully, businesses can determine if such services align with their financial goals and needs.