Effective cashflow management is a critical component for any successful business in the UK. Whether you’re a startup or an established company, understanding and managing your cashflow can mean the difference between thriving or struggling to survive. In this blog, we simplify the concept of cashflow management and its significance for your UK business, offering practical tips and insights to help you maintain a healthy financial state.

Understanding Cashflow: The Lifeblood of Your Business

Cashflow refers to the movement of money into and out of your business. It’s the lifeblood that keeps daily operations running smoothly. Without proper cashflow management, a business may face financial difficulties, regardless of its profits.

Imagine your business as a car. Cashflow is the fuel that powers it. No matter how well-designed the car is, without fuel, it won’t go far. Similarly, consistent cashflow lubricates the gears of business operations, enabling seamless execution of tasks, purchasing of inventory, and payment of wages. Understanding this analogy can help demystify why cashflow isn’t merely an accounting term but a practical requisite for business continuity.

One of the common misconceptions about cashflow is that if a business is profitable, there is no need to worry about it. However, profitability doesn’t always equate to cash availability. For instance, you might have generated significant sales, but if clients delay payments, your cash flow can suffer. This lag creates a ‘cashflow gap,’ during which expenditures might exceed income. Bridging this gap effectively is crucial, ensuring that business functions such as payroll, vendor payments, and other operational costs remain uninterrupted. This further underscores the importance of regular monitoring and assessment of cash inflows and outflows.

Key Challenges in Cashflow Management

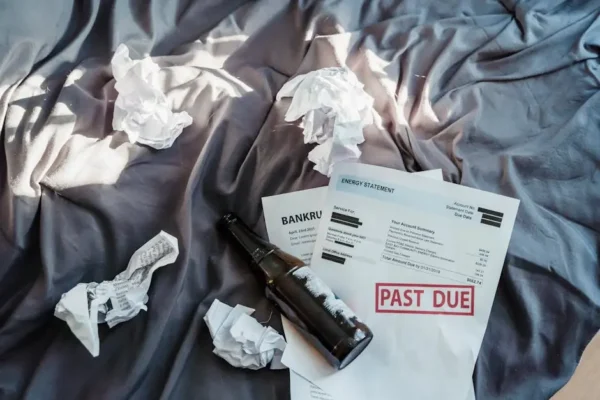

Many UK businesses encounter common obstacles in managing cashflow, such as late payments from clients, unexpected expenses, or seasonal fluctuations in sales. These challenges can strain your cash reserves and impact your ability to meet financial obligations on time.

Late payments are a notorious challenge that can severely impact cashflow stability. For many small to medium enterprises (SMEs), clients delaying payments by even a few days can cause significant operational hiccups. This issue becomes even more intricate when tied with ongoing expenses, such as monthly salaries, utility payments, and supplier costs, that don’t allow for any delay. Crafting robust credit control mechanisms and clear payment terms with clients can alleviate this common burden, ensuring that your cash reserves remain steady.

Strategies to Improve Cashflow

To enhance cashflow, consider strategies like incentivizing early payments, reducing unnecessary expenses, and improving inventory management. Additionally, utilizing modern financial tools and software can provide better insight into your cash position.

Incentivizing early payments is a straightforward yet effective approach to maintaining a positive cash position. Offering discounts for early settlements encourages clients to prioritize your payments, thereby accelerating cash inflows. Simultaneously, scrutinizing and cutting back on non-essential expenses can lead to immediate conservation of cash resources. Another practical tactic is streamlining inventory management. This involves maintaining optimal stock levels to avoid over-purchasing and holding unsold goods, which tie up valuable cash flow. Technologies that track inventory levels in real-time can be beneficial in achieving this balance.

Exploring financing options is another viable strategy. Short-term financing solutions, such as a business line of credit or invoice financing, provide access to liquid funds when needed, bridging any temporary cash gaps. These options offer flexibility, ensuring you have the necessary resources to cover operational costs during tough financial periods. However, it’s important to approach these opportunities judiciously, understanding the terms and interest rates to avoid long-term debt traps.

The Role of Forecasting in Cashflow Management

Creating accurate cashflow forecasts involves predicting future cashflow trends based on historical data. This practice helps businesses prepare for upcoming expenses and identify potential shortfalls before they occur, thereby reducing financial risk.

Forecasting is much like having a business GPS that navigates future financial terrains. By projecting expected revenues and expenses, businesses can anticipate cash requirements, ensuring they remain prepared for both expected and unexpected financial demands. Such foresight not only aids in smoother financial planning but also informs strategic decisions, such as scaling operations, launching new products, or entering new markets without overly stretching financial capacity. Embracing technology-driven forecasting tools can enhance accuracy and provide dynamic, real-time updates that equip business owners with the insights to act proactively.

Furthermore, regular revision of cashflow forecasts is essential as it allows adaptability to changing circumstances. Factors like economic shifts, industry trends, or market demands can influence forecasted outcomes significantly. By continuously refining these forecasts, businesses maintain a clear view of their cashflow status, allowing them to stay agile and responsive in a dynamic business environment. This ongoing evaluation is pivotal in ensuring that financial strategies remain aligned with current business realities and future growth objectives.

Secure Your Business’s Financial Future

In conclusion, prioritizing cashflow management is essential for securing a stable and prosperous future for your UK business. By actively monitoring cash inflows and outflows, preparing for financial challenges, and leveraging tools and strategies to improve cashflow, you can ensure your business remains financially resilient. Remember, effective cashflow management isn’t just about keeping your business afloat—it’s about positioning it for growth and success.