Navigating the path to recovering business loan debt can seem daunting, but understanding the steps involved can make the process more manageable. This guide will break down the key stages in business loan debt recovery, providing a clear path forward.

Assess the Situation

Begin by evaluating the scope of the debt and the surrounding circumstances. Understanding your financial position and the specifics of the loan agreement is crucial to formulating a strategic plan.

Take a comprehensive look at your company’s financial health. This involves reviewing cash flow statements, balance sheets, and outstanding obligations. With a clear financial snapshot, you can better understand where your business currently stands.

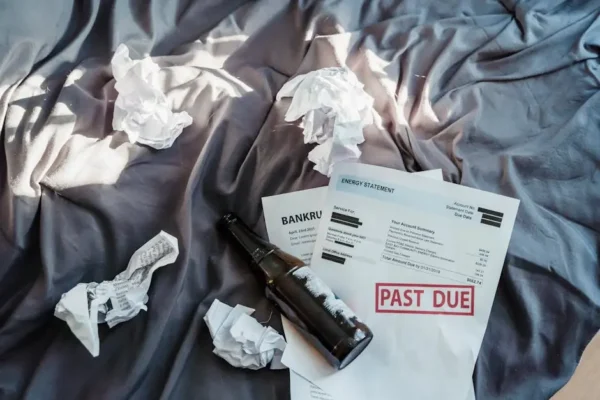

Beyond the numbers, assess any underlying issues that may have contributed to the debt. Is there a seasonal slump affecting revenues, or perhaps operational inefficiencies? Identifying these factors early can help in crafting a tailored recovery strategy.

Don’t overlook the importance of setting realistic goals during your assessment. Knowing what you aim to achieve in the debt recovery process allows for more focused and effective planning.

Communicate with the Lender

Open lines of communication with your lender to discuss your options. They may provide advice, opt for restructuring the loan, or agree on a new payment plan. Having an open dialogue is vital for a favorable outcome.

Being upfront about your financial struggles can open doors to previously unavailable options. Lenders often prefer negotiating terms over enforcing penalties, as recovering the owed amount is in their best interest too.

Prepare for these discussions by having all necessary documents ready. Whether it’s proof of income or revised financial projections, being organized can smooth the negotiation process.

Engaging in regular updates with your lender helps build trust, which can be crucial for long-term business relationships. Keep the communication ongoing, even if there are no major developments.

Consider Professional Help

Engage financial advisors or debt recovery specialists. These professionals can offer insights and strategies tailored to your specific situation, often accelerating the recovery process.

Professionals bring an objective perspective to your financial challenges. Experienced advisors can identify blind spots in your strategy, offering solutions you might not have considered.

Consulting with legal experts can also be beneficial, especially if your loan agreements contain complex clauses that require careful navigation.

While there are costs associated with hiring professionals, the investment often pays off in the form of reduced debt burden and improved financial strategies.

Implement a Debt Recovery Plan

Once a strategy is formulated, implement the debt recovery plan meticulously. This may include restructuring debt or liquidating assets, depending on the agreement with the lender.

Prioritize your actions based on the plan outlined. For example, focus on paying off high-interest debts first or those with immediate penalties. This systematic approach can lead to faster recovery.

Transparency in execution is key. If there are changes in your financial situation or the business environment, update all stakeholders involved to maintain alignment with your recovery goals.

Monitor Progress and Adjust

Regularly review the recovery strategy’s progress. Be ready to tweak the plan as necessary to ensure the best outcome, keeping in mind any changes in the business or financial landscape.

Create benchmarks to track the success of your recovery efforts. Whether it’s the reduction of monthly payments or improvement in cash flow, these indicators can guide future steps.

Flexibility is crucial. As you monitor progress, be prepared to adapt your strategy. Economic conditions or changes in business demands may require shifts in your debt recovery approach.

Celebrate small victories along the way. Each step towards debt reduction is a testament to your efforts, providing motivation to continue on the path to financial recovery.

Wrapping Up: Key Steps in Business Loan Debt Recovery

Recovering business loan debt involves a series of strategic steps, from assessment to resolution. By understanding and implementing these steps, businesses can effectively manage their debt recovery process and work towards financial stability.