In the world of business, managing finances is crucial, and sometimes companies face the challenge of unpaid invoices. This article explores how commercial debt recovery services can be a valuable solution, helping businesses navigate these tricky waters effectively.

Understanding Commercial Debt Recovery Services

Before diving into when a business should consider these services, it’s important to understand what commercial debt recovery involves. These services are provided by specialized agencies that help recover unpaid debts efficiently, allowing businesses to focus on their core operations.

Think of commercial debt recovery as having a trusted partner in your corner. These experts are trained to handle sensitive situations delicately, ensuring that debt recovery does not harm existing client relationships. They act as intermediaries to professionally negotiate debt repayments and settlements.

The process usually begins with a thorough assessment of outstanding debts and the creation of a strategic plan tailored to the business’s specific situation. This might include a range of options from direct negotiations with debtors to legal proceedings if necessary.

Signs That Indicate a Need for Debt Recovery Services

There are several indicators that a business might need to consider commercial debt recovery services. These include a significant amount of outstanding invoices, consistent difficulty in collecting payments, and a lack of resources to efficiently follow up on debts.

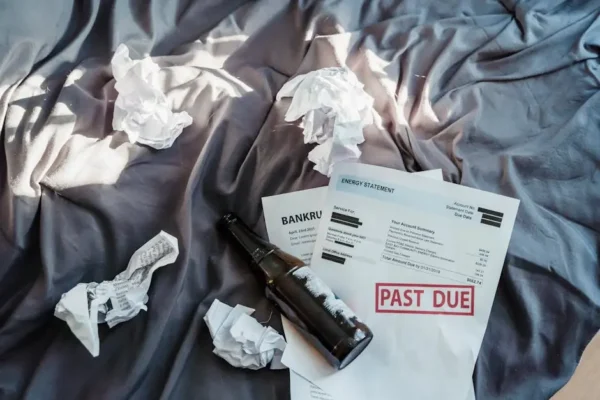

If a business finds that more than 30% of its accounts receivable is overdue, it may be time to consider these services. This level of outstanding debt can begin to impact the company’s cash flow, limiting its ability to invest in growth opportunities.

A significant increase in credit terms being ignored by clients is another red flag. When clients regularly exceed agreed payment terms despite reminders, professional intervention might be needed to resolve these issues.

Sometimes, internal resources might be insufficient for effective debt collection, especially in smaller businesses. In such cases, outsourcing debt recovery can allow the team to focus on other critical aspects of business operations without disruption.

Benefits of Using Commercial Debt Recovery Services

Utilizing commercial debt recovery services offers numerous benefits. These can include improved cash flow, time savings, and the expertise of professionals who know the best strategies for recovering debts while maintaining customer relationships.

One of the primary advantages is the ability to recover debts more quickly. This influx of cash can directly impact the business’s operational capability and financial stability. It also allows businesses to forecast more accurately without the uncertainty of when overdue accounts might be settled.

Professional debt recovery services offer a level of expertise that in-house teams may lack. These agencies are knowledgeable about the legalities of debt collection and can pursue avenues that might not be apparent to non-specialists.

Moreover, using external services can help preserve important business relationships by taking the pressure off personal interactions. Agencies act as a buffer, ensuring that business owners can maintain a healthy rapport with clients while still addressing outstanding debts.

Choosing the Right Debt Recovery Service Provider

When deciding to engage a debt recovery service, selecting the right provider is crucial. Businesses should consider factors like the provider’s reputation, success rate, fee structure, and the ability to tailor services to meet the company’s specific needs.

It’s wise to conduct thorough research and seek recommendations from peers. A provider with a strong track record will often have testimonials or case studies available, offering a glimpse into their success stories.

The fee structure is also an essential consideration. Some agencies might operate on a no-recovery-no-fee basis, which can be appealing for businesses concerned about upfront costs.

Ultimately, the right provider will work closely with your business to develop a customized approach. They will understand the nuances of your specific industry and advise on appropriate strategies.

Key Takeaway: Smart Financial Practices

Commercial debt recovery services can play a pivotal role in enhancing a business’s cash flow and maintaining financial stability. By recognizing the right time to engage these services, companies can ensure healthier financial practices and focus on their growth initiatives without the stress of unpaid debts.