B2B debt collection is a crucial aspect of business operations, ensuring that cash flows remain steady and companies maintain healthy financial positions. However, collecting payments and managing receivables in a B2B context presents unique challenges. In this blog, we’ll explore these key challenges and provide insights into how businesses can effectively address them.

Understanding the Complexity of B2B Transactions

B2B transactions often involve larger sums, multiple departments, and complex documentation. This complexity can make the collection process more intricate and time-consuming, requiring clear communication and effective systems.

The sophisticated nature of these transactions means that any miscommunication can lead to significant delays. It’s not uncommon for discrepancies in shared documents to arise, which can prolong the payment process. Companies need to ensure their teams are well-trained in handling such intricacies to maintain efficiency.

Another layer of complexity is added by multi-level approval hierarchies. In larger companies, invoices often need to go through several levels of approval before they are paid. This can be frustrating and slow down the process significantly.

Managing Client Relationships

Maintaining strong relationships with clients is crucial in B2B settings. Balancing assertive collection efforts with preserving positive client connections can be challenging, necessitating careful negotiation and collaboration.

It’s essential to adopt a client-centric approach. By understanding your client’s business cycle and financial pressures, you can craft payment terms that are mutually beneficial while also ensuring your cash flow remains unaffected. Open dialogue is key.

Technology can aid in managing these relationships more effectively. Using CRM tools allows businesses to track interactions and customize communication strategies, creating a more personalized experience for clients while still being consistently firm about payments.

Remember, a good relationship can be a buffer in difficult times. Clients are more likely to prioritize payments to businesses that are perceived as partners rather than mere vendors. Cultivating this perception requires ongoing effort but yields substantial returns.

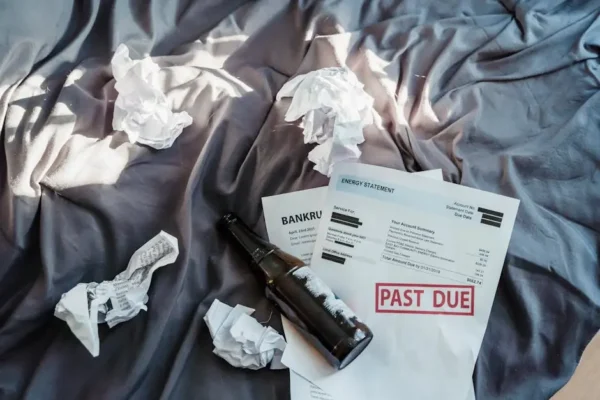

Dealing with Long Payment Cycles

B2B transactions often come with extended payment terms. These extended cycles can strain cash flow and create additional pressure on businesses to manage their finances efficiently.

To mitigate the impact of long payment cycles, having a robust financial forecasting plan is essential. Businesses should analyze historical payment data to predict cash flow trends and prepare accordingly. This proactive approach minimizes surprises.

Implementing early payment discounts can be a motivational tool. By offering slight reductions on invoices paid before the due date, companies can encourage quicker payments, effectively reducing the lag time inherent in the typical B2B cycle.

Legal and Regulatory Considerations

Businesses must navigate various legal and regulatory frameworks when collecting debts, varying from one region or industry to another. Compliance with these regulations is essential to avoid potential legal troubles.

Understanding these legalities can be daunting. Each jurisdiction may have its own set of rules regarding how collections can be handled, and being informed is the best way to protect your company. Regular training sessions for the debt collection team can ensure they are up-to-date.

Consultation with legal experts is another critical step. Having a legal professional review your collection practices can provide peace of mind and ensure your practices are within legal boundaries. This is an investment in preventing costly mistakes down the road.

Implementing Effective Collection Strategies

Employing strategic approaches, such as leveraging technology and tailoring communication tactics, can optimize the collection process. Effective strategies help streamline operations and improve collection rates.

Automation can significantly enhance efficiency in collections. By automating routine follow-ups and reminders, companies can focus their resources on addressing more complex issues. This not only leads to faster collections but also reduces human error.

Tailor your communication strategy to save valuable client relationships. For instance, while a friendly reminder might work for some clients, others may need more frequent and formal communication. Keeping a detailed record of all interactions can help personalize this approach.

Addressing B2B Debt Collection Challenges

In the complex world of B2B debt collection, understanding and addressing the key challenges is essential for maintaining strong, financial health and positive client relationships. By acknowledging these hurdles and employing strategic solutions, businesses can streamline their receivables process and enhance overall performance.