Navigating cash flow can be a tricky affair for B2B businesses, but understanding cash flow solutions can make a huge difference. Let’s break down what B2B cash flow solutions are and why they should be important to your business strategy.

Understanding B2B Cashflow Solutions

B2B cashflow solutions are financial tools and strategies designed to manage and improve the cash flow of business-to-business transactions. They help businesses maintain a balanced and healthy financial pipeline, ensuring operations run smoothly without financial hiccups.

In the business world, cash flow can be seen as the lifeblood that keeps the heart of operations pumping. B2B cashflow solutions work by providing methods to better track incoming and outgoing payments, ensuring that companies have enough liquidity to meet their obligations in a timely manner. This capability is crucial for day-to-day operations and long-term planning.

Moreover, these solutions can also be thought of as a financial buffer, offering businesses the flexibility to adapt to changes in market conditions or unexpected expenses. They allow businesses to forecast their financial positions more accurately, which is essential for making informed strategic decisions.

Why Cashflow Solutions Matter

Cash flow solutions are crucial because they assist businesses in managing their finances more effectively. They help in avoiding cash shortfalls, ensuring that there are always funds available to cover expenses and invest in growth opportunities.

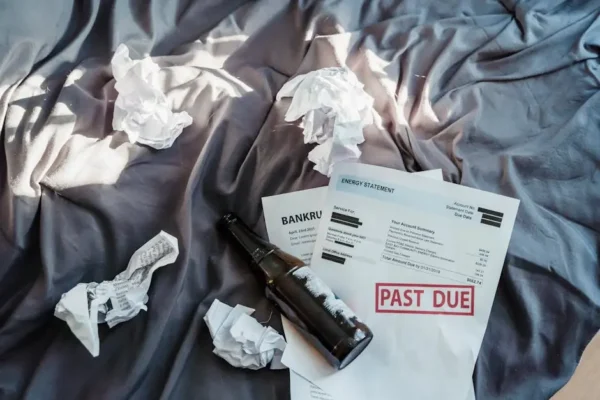

Without proper cash flow management, even profitable businesses can face financial distress. This is where cashflow solutions step in, bridging the gap between revenue inflow and expense outflow. They ensure that a business has quick access to cash when needed, reducing the risk of financial bottlenecks that can halter operations.

Furthermore, these solutions help in maintaining healthy relationships with suppliers and customers. By ensuring payments are made promptly, businesses can foster trust and reliability, opening doors for better negotiation terms and loyalty from partners. This is especially impactful in a B2B context where transactions often involve larger sums and longer payment cycles.

Different Types of B2B Cashflow Solutions

Some popular cash flow solutions include invoice financing, factoring, and lines of credit. Each of these offers unique benefits and can be tailored to fit specific business needs, helping to manage cash flow efficiently.

Invoice financing allows businesses to use their unpaid invoices as collateral for short-term funding. This approach can free up cash that’s tied up in accounts receivable, providing companies with the liquidity they need to manage operations smoothly.

Factoring involves selling invoices to a third party at a discount. While this may slightly reduce the profit margin, it offers immediate cash. This method is particularly useful for companies that face extended payment terms from clients but require instant cash to keep their wheels moving.

Lines of credit provide businesses with a safety net – a flexible source of funds that they can draw on when necessary. Unlike a traditional loan, you only pay interest on the funds actually used, making it a cost-effective option for managing temporary cash burdens.

How to Choose the Right Cashflow Solution

Choosing the right solution depends on your business model, cash flow cycle, and strategic goals. Consider factors such as cost, flexibility, and your specific cash flow challenges when selecting a solution.

Start by assessing your current cash flow management processes. Understanding where delays occur, why funds are tied up, and which transactions are most challenging is crucial. Once you’ve mapped out your specific cash flow challenges, you can better evaluate which solutions align with those needs.

Costs and fees associated with each solution should also be scrutinized. Some options might offer quick cash access but at a higher cost, while others might be cost-effective but less flexible. Aligning your choice with your company’s financial philosophy and goals is key to ensuring a harmonious fit.

Additionally, seeking professional advice or consulting with a financial advisor can provide valuable insights into the suitability and implications of implementing certain cash flow solutions. They can offer a more objective analysis of your business’s cash flow needs and the best solutions to meet them.

Implementing Cashflow Solutions Effectively

Successful implementation involves integrating these solutions seamlessly into your financial operations. Regularly review their effectiveness and adapt strategies as your business evolves to maintain optimal financial performance.

Effective implementation requires not just choosing the right solution but also establishing a systematic approach for its application. This involves setting up a monitoring system to keep track of cash flow patterns and adjusting strategies in response to changes in these patterns.

Communication across departments is pivotal. Ensuring that all stakeholders understand how and why certain cash flow solutions are being employed can help in aligning the financial objectives with overall business goals, fostering a proactive environment.

Finally, staying informed about the latest trends and developments in cash flow management can provide you with new tools and approaches that can enhance your existing strategies, offering you a competitive edge in the dynamic business landscape.

The Vital Role of B2B Cashflow Solutions

Incorporating effective B2B cash flow solutions can significantly enhance your business’s financial stability and flexibility. By embracing these solutions, companies can ensure timely payments, optimize their operations, and boost overall financial health.