In the world of business, maintaining efficient operations is key to success. One area often overlooked, yet crucial to boosting business efficiency, is accounts receivable. By developing solid accounts receivable processes, businesses can ensure they have the cash flow needed for growth and sustainability. Let’s explore how strengthening this aspect can provide significant advantages.

Understanding the Role of Accounts Receivable

Accounts receivable is a critical component of your business’s financial health. It represents money owed to your business for goods or services provided but not yet paid for. Proper management of accounts receivable ensures you have the resources to meet operational expenses and invest in growth.

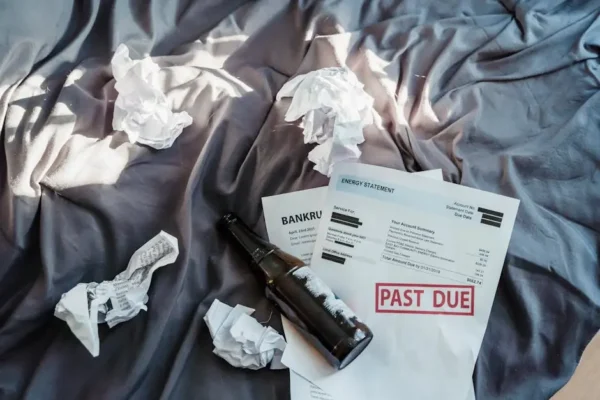

The lifeline of any business is its cash flow, and accounts receivable sits right at the heart of this flow. Imagine your business as a bucket and cash flow as the water—accounts receivable are essentially the stream filling your bucket. Efficiently managing this stream means that you are in control of your financial stability and operational capacity. It influences everything from paying your employees on time to making strategic investments that spur growth. Failure to manage accounts receivable effectively can leave your business high and dry, unable to react to opportunities or threats.

Moreover, accounts receivable management isn’t just about ensuring payments arrive; it’s about making sure they arrive when expected. Timely payments help maintain a regular cash flow, which can be used to settle your accounts payable, thereby preventing the need for costly financing solutions. A well-managed accounts receivable process helps you anticipate your incoming cash and plan accordingly, allowing for a smoother financial operation overall. By understanding this essential role, businesses can take active steps to solidify their financial foundation.

Implementing Proactive Credit Policies

By establishing clear credit policies, you can reduce the risk of late payments and bad debt. Proactive credit management involves setting credit limits, conducting thorough credit checks, and communicating terms clearly to your clients.

A strong credit policy serves as the backbone of your accounts receivable strategy. It not only reduces potential risks associated with granting credit but also sets clear expectations for clients, helping to foster healthy business relationships. Start by setting credit limits that are reasonable and proportionate to your clients’ credit history and financial standing. This approach minimizes the likelihood of clients overextending themselves and becoming unable to meet their obligations. Conducting thorough credit checks is another step that cannot be overlooked. This involves delving into the financial history of potential clients to understand their ability or willingness to pay.

Communicating your credit terms effectively is equally important. Your terms should be clear and concise, leaving no room for misunderstandings. Clearly outline payment schedules, interest rates on overdue accounts, and potential consequences for late payments—this transparency helps prevent disputes and ensures that clients know exactly what is expected of them. Remember, a proactive credit policy acts as a preventative measure, guarding your business against unexpected cash flow interruptions and ensuring that your accounts receivable remain a reliable source of income.

Streamlining the Invoicing Process

A streamlined invoicing process is crucial for prompt payments. Ensure invoices are accurate, detailed, and sent promptly. Consider automating the invoicing process to minimize human errors and improve efficiency.

When it comes to invoicing, accuracy is key. An invoice with errors not only delays payments but also damages trust with your clients. Take the time to ensure every detail on your invoice is correct, from quantities and pricing to the terms of payment. In addition to accuracy, timeliness is paramount. The sooner you send out an invoice, the sooner you can expect payment. Late invoices can disrupt your cash flow and complicate your financial planning. Implementing a system where invoices are sent promptly after a service is rendered or a product is delivered can drastically improve payment times.

Automation is your ally in creating a flawless invoicing system. Many businesses find that automating their invoicing process with specialized software not only reduces the occurrence of human error but also significantly speeds up the entire process. Automated systems can generate and send invoices immediately upon completion of a transaction and set up reminders for overdue bills. They also provide valuable insights into your accounts receivable status, alerting you to potential issues before they become significant problems. By investing in automation, businesses can streamline their invoicing process to be more effective and efficient.

Effectively Managing Overdue Payments

Handling overdue payments efficiently is essential for maintaining cash flow. Implement a structured follow-up system for late payments, and consider offering discounts for early payments as an incentive for clients.

One of the realities of accounts receivable management is that not all invoices will be paid on time. However, how you manage overdue accounts can make the difference between a minor inconvenience and a serious cash flow problem. Begin by setting up a structured follow-up system. This could involve a series of reminders—both gentle and firm—sent out to clients at different stages of delinquency. The goal is to encourage timely payment without damaging the client relationship. For instance, a gentle email reminder at the outset, followed by a more formal letter, and eventually a personal call if necessary, can effectively manage overdue payments.

Leveraging Technology for Enhanced Efficiency

Technology offers numerous tools to optimize accounts receivable processes. From accounting software that tracks revenue and invoices to automated reminders for clients, leveraging technology can significantly enhance efficiency.

The digital age has brought with it an array of technologies that can revolutionize accounts receivable processes. Accounting software like QuickBooks or FreshBooks provides powerful tools for tracking invoices, client interactions, and payments. These platforms offer a wealth of data at your fingertips, allowing you to quickly assess your outstanding invoices, cash flow status, and more, providing the insight you need to make informed financial decisions. Furthermore, many of these solutions offer cloud-based services, ensuring that you can access your financial data anytime, anywhere—an essential feature for today’s mobile business operations.

Automation technologies, such as electronic data interchange and optical character recognition, further enhance efficiency by reducing manual input errors and speeding up the documentation process. These technologies can automatically generate invoices from sales data, cross-reference purchase orders with delivery notes, and more, freeing up valuable time for your team to focus on strategic financial planning. The integration of such technology into your accounts receivable processes not only improves accuracy and speed but can also provide a more seamless experience for your clients, encouraging timely payments and strengthening business relationships. Embrace technology and watch your accounts receivable processes transition from cumbersome tasks to streamlined, efficient operations.

Wrapping Up: The Power of Effective Accounts Receivable Management

To sum up, strong accounts receivable processes are essential for enhancing business efficiency and ensuring financial health. By implementing proactive credit policies, streamlining invoicing, carefully managing overdue payments, and leveraging technology, businesses can significantly improve their cash flow and financial management. Taking these steps will set your business on a path to sustained efficiency and growth.