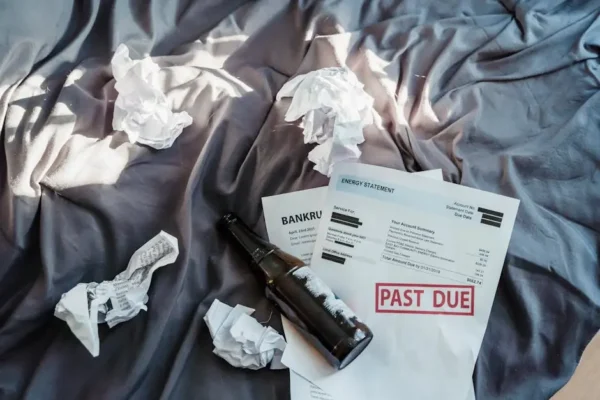

Dealing with debt can be overwhelming, and finding a path to recovery is crucial for financial stability. Cashflow solutions can be a significant factor in this recovery process. But what exactly are cashflow solutions, and how can they aid in debt recovery? This FAQ blog will delve into the role these solutions play, offering clear insights to help you navigate your financial journey.

Understanding Cashflow Solutions

Cashflow solutions involve strategies and tools that help manage the inflow and outflow of money in your financial system. They are crucial for individuals and businesses aiming to maintain a balanced financial state.

Think of cashflow solutions as the navigators of your financial ship, steering you through the unpredictable seas of income and expenditure. They ensure that you remain afloat during tough times by monitoring and adjusting the way money comes in and goes out.

For businesses, cashflow solutions may include detailed budget forecasts, variance analysis, and precise accounting practices. For individuals, incorporating simple budgeting tools and savings strategies can be extremely effective in managing monthly expenses.

The importance of maintaining a positive cashflow cannot be overstated. It not only aids in day-to-day operations but also ensures that you have the financial capacity to respond to sudden opportunities or unexpected challenges.

How Cashflow Solutions Aid Debt Recovery

Cashflow solutions assist in debt recovery by ensuring you have enough funds available to meet your debt obligations. They help prioritize payments and manage resources effectively.

Imagine trying to pay off debt without knowing exactly how much you have to spend. This is where cashflow solutions come in—they provide clarity in your financial landscape, helping you allocate resources intelligently.

By implementing effective cashflow solutions, you can avoid the pitfall of further debt accumulation. They allow you to systematically pay down liabilities, often setting up a ‘snowball effect’ where you pay off the smallest debts first, gaining momentum with each repayment.

Cashflow solutions often include setting up automatic payments, which can prevent late fees and interest charges that compound your financial woes. Automation can be a powerful ally in staying debt-free.

Key Strategies for Improving Cashflow

Improving cashflow can involve various strategies such as reducing expenses, restructuring debts, or increasing income streams. These actions can create a more favorable financial balance, making debt repayment more manageable.

Consider renegotiating with creditors to extend payment terms or reduce interest rates, which can lead to significant monthly savings. Regularly reviewing bills for areas to cut costs can also help.

Embracing additional income opportunities, like a side gig or freelance work, can bolster cashflow, making it easier to keep up with obligations. Remember, every little bit counts when it comes to debt recovery.

Another effective method is to regularly review and adjust your financial plan. This ensures that your debt recovery strategy remains aligned with your current financial circumstances and goals.

The Role of Professional Assistance

Seeking professional help like financial advisors or debt counselors can be beneficial. They provide personalized cashflow solutions and debt recovery plans tailored to your unique situation.

Experts in financial management can offer the guidance needed to navigate the complexities of debt recovery. They can point out areas where you might be overspending and propose methods to streamline your finances.

Professional assistance can also bring peace of mind. Knowing that an expert is watching over your finances allows for greater focus on other areas of life, reducing stress and anxiety linked to money matters.

Remember to choose professionals who understand your specific needs. Whether dealing with large-scale business debts or personal financial setbacks, the right advisor can make all the difference in your recovery journey.

Embracing Cashflow Solutions for Effective Debt Recovery

Cashflow solutions are integral to the debt recovery process, offering practical ways to manage finances and reduce liabilities. By improving your cashflow, restructuring debts, and seeking professional help, you can take significant strides toward financial health. Remember, achieving debt recovery is a journey, and with the right solutions, you can be well on your way to financial stability.