In today’s business landscape, managing finances efficiently is crucial for success. A key component of this is understanding accounts receivable. But what exactly are accounts receivable, and why should UK businesses pay attention to them? In this FAQ-style blog, we’ll break down the basics of accounts receivable and explore their significance in the UK business environment.

What Are Accounts Receivable?

Accounts receivable refer to the outstanding invoices or the money owed to a company by its customers for goods or services delivered but not yet paid for. They are considered a current asset on a company’s balance sheet, reflecting the company’s ability to collect funds.

When a business sells its products or services on credit, it creates accounts receivable. This means the business has extended a line of credit to its customer, with an agreement to receive payment within a specified period. It’s important to note that managing your accounts receivable efficiently is crucial in ensuring good cash flow.

Most UK businesses deal with accounts receivable on a daily basis. This is particularly crucial for companies operating in industries where trade credit is common, such as manufacturing and wholesale. Understanding what constitutes accounts receivable and their role on the balance sheet can help businesses make informed financial decisions.

Why Are Accounts Receivable Important?

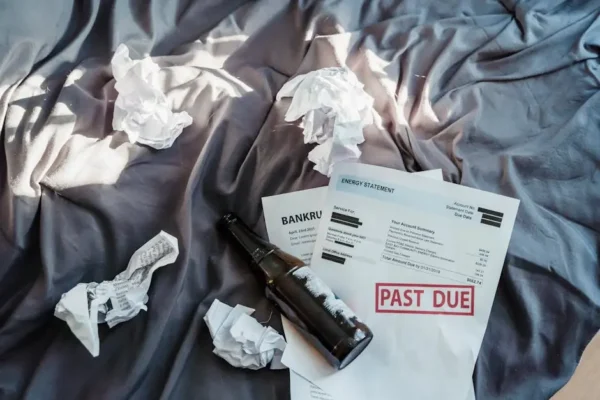

Accounts receivable play a pivotal role in maintaining cash flow. Timely collection of receivables ensures that the business has the necessary funds to cover its own operational expenses, invest in growth, and meet financial obligations.

Cash flow is the lifeblood of any business. Without a steady influx of cash, businesses may struggle to cover their costs, pay suppliers, or seize new opportunities. Therefore, managing accounts receivable effectively is essential to avoid disruption.

In addition to cash flow management, accounts receivable offer insights into a company’s financial health and credit policies. By analyzing accounts receivable, businesses can identify trends in customer payment behaviors and adjust credit terms as necessary.

Ultimately, well-managed accounts receivable achieve two vital goals: customer satisfaction (by having transparent billing processes) and business sustainability (by optimizing cash collections).

How to Track Accounts Receivable Efficiently

Effective tracking involves using reliable accounting software to monitor invoicing, customer payments, and outstanding debts. This helps businesses stay on top of their financial health and anticipate potential cash flow issues.

One of the best tools for tracking accounts receivable is implementing an automated accounting system. Automating reminders for overdue invoices and integrating payment gateways can streamline the billing process.

Regularly reviewing detailed accounts receivable aging reports can also provide insight into which customers may be habitual late-payers. Prioritizing these accounts for follow-up can prevent cash flow hiccups and reduce the likelihood of bad debt.

In larger organizations, dedicated accounting teams often manage receivables. Their specialization can help reduce errors, streamline workflows, and improve collection times, allowing the company to maintain a healthier cash position.

Strategies for Managing Accounts Receivable

To manage accounts receivable effectively, businesses can implement clear credit policies, offer early payment discounts, and regularly review receivables aging reports. This proactive approach encourages prompt payment and reduces the risk of bad debt.

Establishing clear terms and conditions prior to extending credit is imperative. These terms set expectations and minimize disputes down the line. Ensure all terms are detailed in written agreements to avoid misunderstandings.

Another effective strategy is to incentivize early payments by offering discounts. For instance, a 2% discount for payments made within ten days of the invoice date can encourage customers to pay sooner.

Regular communication with customers is key. A gentle reminder on the due date, or a friendly follow-up call shortly after can prompt timely payments. Remember, most customers value good business relationships and appreciate proactive communication.

In more complex scenarios, some businesses might opt to work with third-party collection agencies for persistent overdue accounts. While this should be a last resort, it can recover funds that might otherwise remain uncollected.

Wrapping Up Accounts Receivable for UK Businesses

In summary, accounts receivable are a critical component of managing a successful business in the UK. By understanding their importance, tracking them meticulously, and employing effective strategies to manage them, businesses can enhance their cash flow, support growth, and improve their financial stability. Emphasizing these aspects in your business strategy can lead to more sustainable success in the competitive UK market.