Starting a business is an exciting journey, but tackling business finance can be daunting for many UK startups. This guide aims to simplify things, making financial concepts accessible and manageable, helping you focus on what you do best – growing your business.

Understanding the Basics of Business Finance

To effectively manage your startup’s finances, it’s crucial to have a solid understanding of the basic financial concepts. This includes familiarizing yourself with terms like cash flow, profit margins, and financial statements. Knowing these can set a strong foundation for your financial journey.

One of the first steps is to understand your financial statements, such as the balance sheet, income statement, and cash flow statement. These documents are more than just a collection of numbers; they tell the story of your business’s financial health. A balance sheet summarizes what your company owns and owes, offering a snapshot at a specific point in time. Meanwhile, the income statement reveals your profitability by comparing revenue against expenses over a given period. By regularly reviewing these documents, you ensure that you’re making informed decisions rooted in your company’s financial reality.

Besides financial statements, another critical concept is cash flow, which refers to the inflow and outflow of cash within your business. Always aim for positive cash flow, meaning more cash is coming in than going out. This situation allows you to cover expenses, pay debts, and invest in growth opportunities. Moreover, understanding the difference between fixed and variable costs can aid in budget planning. Fixed costs remain constant regardless of production levels, like rent or salaries, whereas variable costs fluctuate with business activity, such as raw materials.

Setting Up a Financial Plan

Having a financial plan is like having a roadmap for your startup. It outlines your financial goals and provides guidance on how to achieve them. Learning to create and adjust your financial plan as your business grows is integral to maintaining financial health.

Start by setting realistic and measurable financial goals. Are you aiming for a specific revenue target in your first year, or do you desire to achieve a breakeven point by a certain date? Clearly defined goals pave the way for strategic planning and execution. Moreover, your financial plan should encompass short-term objectives as well as long-term aspirations. While the former focuses on operational aspects like month-to-month budgeting, the latter considers growth metrics and market expansion over several years. A well-rounded plan thus balances immediate needs with future ambitions, adjusting strategies when necessary.

Scenario planning can be a powerful tool within your financial strategy. By envisioning various potential business situations, such as an unexpected market downturn or a sudden spike in expenses, you can prepare contingency plans. This proactive approach can mitigate risk and increase your business’s resilience. Furthermore, assessing your competition provides valuable insights. Understanding their strengths and weaknesses can help refine your offering and identify opportunities to capture market share, thereby influencing your financial outcomes positively.

Budgeting for Your Startup

Budgeting is a vital part of good financial management. For UK startups, this involves carefully planning your income and expenses to ensure you can meet your financial obligations. Sticking to your budget helps keep your business on track towards profitability.

When it comes to budgeting, the phrase ‘measure twice, cut once’ holds significant relevance. Begin by detailing every source of income you expect. This could be from sales, investments, or loans. Next, list all your projected expenses, both fixed and variable. These might include costs for utilities, marketing strategies, office supplies, and staff salaries. Remember to account for unexpected costs by including a contingency fund in your budget. This small buffer will serve to cover unforeseen expenses without derailing your financial plan.

Tracking expenses regularly is crucial to effective budgeting. Use accounting software to streamline this process, providing a real-time view of your financial position. As you track your spending, look for areas where you can cut costs. Perhaps there’s an opportunity to negotiate better terms with suppliers or automate processes to reduce labor expenses. Each small saving contributes to your overall profitability. Additionally, periodically revisiting your budget ensures it remains aligned with your business’s evolving priorities and market trends.

A zero-based budgeting approach can be particularly beneficial for startups. Unlike traditional methods, zero-based budgeting requires justifying each expense for every new period, allowing no assumptions about previous spending. This method encourages diagnosing what functions are absolutely necessary and discarding anything that doesn’t contribute directly to business results. By adopting such a disciplined budgeting strategy, startups can better allocate resources, maximize cost efficiency, and ensure every pound is directed toward generating value.

Managing Cash Flow Effectively

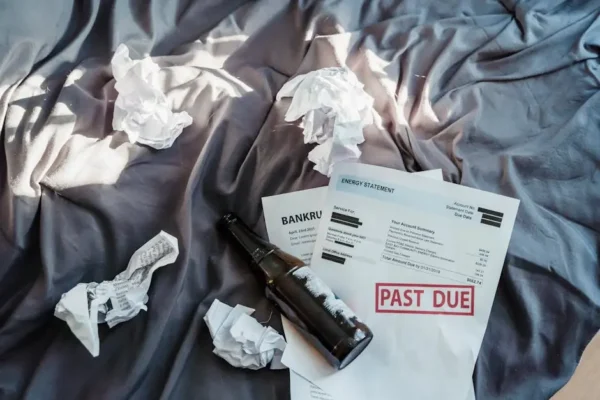

Cash flow can make or break a startup. Learning to manage cash flow effectively ensures your business has enough liquidity to meet immediate and future needs. Regularly monitoring your inflows and outflows can help prevent cash shortages and keep your startup thriving.

Understanding the timing of your income and expenses is essential for maintaining a positive cash flow. For instance, if your business experiences seasonal sales fluctuations, plan for periods when revenues are lower than usual. Implement strategies like prompt invoicing and offering discounts for early payments to encourage quicker receivables. Monitoring your cash flow weekly rather than monthly can help identify potential shortfalls before they become problematic. This proactive approach allows you to make informed decisions, like negotiating with suppliers for extended payment terms or ramping up marketing efforts to boost sales and offset any anticipated dips in cash flow.

Besides income timing, controlling expenditures significantly impacts cash flow management. Regularly review and adjust your operational costs, focusing on creating efficiencies wherever possible. Perhaps there’s an opportunity to migrate to a digital tool that saves time and money compared to older processes. Moreover, maintaining a cash reserve is vital, acting as a safety net during unexpected downturns or when seizing growth opportunities. Access to a line of credit can also provide additional security, offering a quick infusion of funds should the need arise. With effective cash flow strategies in place, a startup can not only survive but also thrive even in challenging market conditions.

Understanding Taxes and Compliance

Complying with UK tax laws and regulations is non-negotiable for startups. Understanding what is required in terms of tax registrations, filings, and deductions can save your business from penalties and legal issues. Keeping up-to-date with compliance ensures smoother operations.

Navigating tax regulations may seem overwhelming, but breaking them down into manageable tasks eases the process. Begin by registering your business with HMRC, which is fundamental for tax purposes. Furthermore, familiarize yourself with VAT requirements. If your taxable turnover exceeds the threshold, you’ll need to register for VAT and submit regular returns, reclaiming VAT on purchases while charging it on sales. Utilizing digital accounting platforms can simplify this process, ensuring timely submissions and reducing administrative hassle.

Expenses incurred for business solely purposes can often be claimed as deductions, reducing your taxable income and, consequently, your tax bill. From office supplies to business travel, knowing what qualifies as a deductible can yield significant savings. Hiring a knowledgeable tax advisor can also be immensely helpful, particularly as your business grows. They can offer tailored advice, helping navigate complex regulations and offering strategies to optimize your tax position. Keeping accurate and organized financial records is crucial, not only ensuring you have necessary documentation during audits but also streamlining tax season preparations.

Seeking Financial Advice and Support

While managing finances can seem daunting, you don’t have to do it alone. Seeking advice from financial experts or mentors can provide valuable insights and guidance. Additionally, exploring government aids and grants can offer support to help grow your startup.

Consider establishing connections with local business networks or startup hubs, where you can meet experienced entrepreneurs who have faced and overcome similar challenges. They can offer firsthand insights, sharing which financial strategies worked for them and which pitfalls to avoid. Engaging with a professional accountant or financial advisor can also prove beneficial. These experts bring a wealth of knowledge and experience, helping you optimize your financial planning and decision-making.

Moreover, the UK government offers various grants and funding opportunities tailored to startups. From Innovate UK to local enterprise partnerships, these schemes can provide much-needed financial resources without the burden of repayment. Conduct thorough research to identify grants that align with your business goals and prepare compelling applications to increase your chances of success. Additionally, crowdfunding has become a viable option for many startups. Platforms like Kickstarter or Seedrs allow you to pitch your business idea to a broad audience, raising funds while simultaneously building a community of supporters who are invested in your success.

Final Thoughts on Simplifying Business Finance

Navigating the financial landscape of a startup doesn’t have to be overwhelming. By breaking down financial tasks into manageable pieces, UK startups can build a strong, sustainable business foundation. Remember, keeping it simple and straightforward is often the key to success.