In the world of business-to-business (B2B) transactions, managing debt collection is a critical aspect for maintaining financial health and stability, especially for owner-managed companies. But why exactly is it so important? This article will explore the significance of B2B debt collection and offer insights into how it can impact business operations.

Understanding B2B Debt Collection

B2B debt collection refers to the process of recovering outstanding debts owed by one business to another. For owner-managed companies, which often operate with limited resources, efficient debt collection is crucial for ensuring cash flow and operational continuity.

Owner-managed companies are typically characterized by their hands-on approach in various aspects of the business, from strategy to day-to-day operations. These businesses are directly impacted by any disruptions in cash flow, making it imperative to have a robust debt collection framework. Without it, even a small percentage of unpaid invoices can strain resources and lead to significant operational challenges.

Understanding the nuances of B2B debt collection involves recognizing the difference between consumer and commercial debts. Commercial debts typically involve larger sums and more complex terms. This makes clear communication and a well-defined procedure for debt recovery vital to minimize misunderstandings and ensure prompt payments. By mastering these processes, owner-managed companies can maintain a stable financial environment.

The Impact of Outstanding Debts

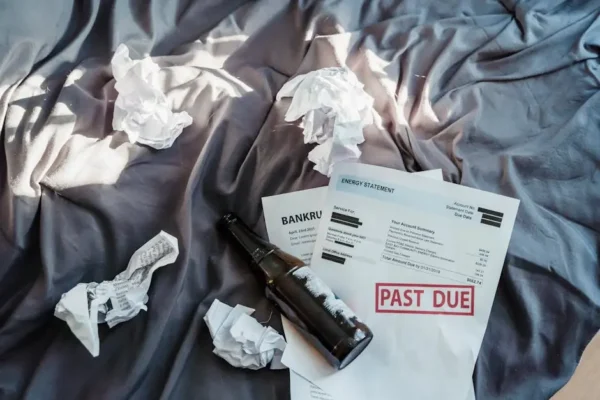

Uncollected debts can disrupt cash flow, hinder growth, and even lead to insolvency. By prioritizing debt collection, owner-managed companies can safeguard their financial health and focus on core business activities without the burden of unpaid invoices.

Every unpaid invoice represents missed opportunities. This is money that could be reinvested into the business for expansion, improving operational efficiencies, or developing new products. The ripple effect of these opportunities being delayed can significantly impact the company’s growth trajectory and competitive positioning.

When cash flow is interrupted by outstanding debts, owner-managed companies may find themselves stretched thin while trying to manage daily operations. It often means cutting costs in areas that are crucial for growth, such as marketing or research and development, essentially compromising future prospects for immediate survival.

Effective Strategies for Debt Collection

Implementing structured strategies like clear credit policies, regular invoicing, and follow-up, can greatly enhance the efficiency of debt collection. These measures ensure that payments are made on time, reducing the risk of accumulated debts.

A proactive approach begins even before offering credit to another business. Assessing the creditworthiness of a potential client through credit reports or industry references can prevent future payment issues. This form of due diligence ensures that the companies you engage with have a track record of honoring their payment commitments.

Automation can be a game-changer in debt collection strategies. Leveraging software tools for scheduling regular reminders, tracking payments, and managing delinquency can streamline the process, reduce errors, and free up valuable time for small businesses to focus on their core operations.

One effective strategy could involve creating a detailed escalation protocol. This means starting with gentle reminders and gradually moving to more formal collection notices if necessary. By having a systematic approach, businesses can ensure consistency in their efforts and maintain professional relationships even when addressing such sensitive matters.

Professional Debt Collection Services

Sometimes, engaging a professional debt collection agency is the best course of action. These agencies specialize in recovering debts while maintaining professional relationships with clients, allowing owner-managed companies to focus on their primary business operations.

Choosing the right debt collection partner can make a significant difference. Experienced agencies know the legal landscape and recovery techniques to optimize collections without alienating clients. They can often recover payments more swiftly and effectively than in-house efforts because they dedicate all of their resources to this highly specialized field.

While there is a cost associated with hiring professional debt collectors, the benefits often outweigh the expenses. By reducing the time spent on collection efforts and improving the rate of recovery, businesses can see a positive impact on their cash flow. This also eliminates stress and negotiation discomfort for the business owner, letting them focus energy where it’s most productive.

The Vital Role of B2B Debt Collection

B2B debt collection plays an essential role in the financial sustainability of owner-managed companies. By understanding its importance, implementing effective strategies, and seeking professional help when needed, businesses can maintain healthy cash flow and inspire growth. Neglecting debt collection might serve short-term convenience, but it risks the very foundation of financial stability and progress.