Starting a new business in the UK is an exciting journey, full of endless possibilities. However, one of the critical elements that can determine the success or failure of a startup is effective cashflow management. In this blog, we’ll explore why managing cashflow is crucial for UK startups and provide practical tips to help you keep your business financially healthy.

Understanding Cashflow and Its Impact on Startups

Cashflow refers to the inflow and outflow of money in your business. It is a critical indicator of financial health. For startups, positive cashflow is necessary to cover operational costs, invest in growth, and cushion against unforeseen expenses.

Let’s start with the basics: why is cashflow so essential for startups specifically? Well, unlike established businesses, startups often operate on a tighter budget and have less room for financial error. A single cashflow issue can quickly spiral out of control when there’s no significant financial buffer to fall back on. Therefore, understanding your cashflow can help you recognize the ebbs and flows of your finances, empowering you to make decisions based on real, accurate data rather than assumptions. It’s about gaining that insight into how much money is moving in and out of your business, and more importantly, when. This timing is crucial because even profitable businesses can suffer if they don’t have the cash available to meet immediate expenses. Thus, cashflow becomes not just a financial metric but a lifeline that sustains the day-to-day operations and long-term viability of your startup.

Common Cashflow Challenges Faced by UK Startups

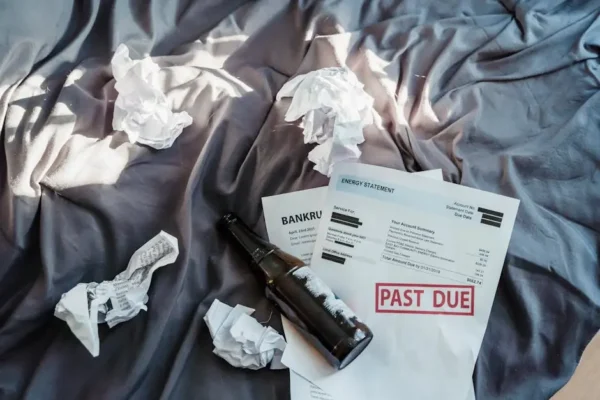

UK startups often face challenges such as delayed payments, unforeseen expenses, and inconsistent revenue streams. These challenges can strain cash reserves, making it difficult to meet financial obligations and plan for future growth.

Delayed payments can be particularly detrimental to startups. Imagine you’ve just closed a big deal, but your client takes 60 or even 90 days to pay. In that waiting period, your bills still pile up, and your employees need their salaries. This delay can disrupt your entire operation. Moreover, inconsistencies in revenue streams introduce another layer of complexity. When your income is unpredictable, making confident financial decisions becomes a game of guesswork. Fluctuating revenue not only hampers your ability to invest in growth opportunities but can also threaten your business’s core functions. Identifying these potential pitfalls beforehand allows you to take proactive measures, such as implementing strict invoicing procedures and establishing a cash reserve.

Another pervasive challenge is the human element—often startups are run by passionate individuals who may not have extensive experience in financial management. Enthusiasm and innovation might drive the enterprise forward, but without a solid handle on cashflow, even the most innovative startups can falter. The unpredictable market shifts and economic changes bring their own set of worries, as conditions can change rapidly, affecting both cost structures and customer demands. By recognizing these challenges in advance, startups can equip themselves with the necessary tools to avert potential pitfalls and build a robust foundation for sustainable growth.

Strategies for Effective Cashflow Management

Implementing strategies such as regular cashflow forecasting, tightening credit controls, and optimizing expense management can significantly improve cashflow. These steps help in maintaining liquidity and ensuring financial stability.

One of the most effective strategies for managing cashflow is consistent cashflow forecasting. It’s not just about predicting how much money will come in and out but understanding the fluctuations that may occur and planning accordingly. Use forecasting to identify lean periods and create a buffer to tide you over those times. This approach requires a thorough examination of historical financial data, market trends, and upcoming projects or contracts. It makes for a proactive rather than reactive stance, allowing startups to make informed decisions about expenditures, investments, and savings.

Tightening credit controls is another critical strategy. By being diligent about whom you extend credit to, you ensure that your cash isn’t tied up in unpaid invoices. Implementing a clear credit policy and sticking to it can prevent future cashflow headaches. That might mean conducting credit checks on new clients or setting stricter payment terms. While this might seem burdensome, it’s a necessary step to safeguard your business’s finances. On the other hand, optimizing expense management is equally vital. Regularly reviewing and adjusting business expenses can uncover areas where you can cut costs without impacting the quality of your services. Simple changes, such as reducing overheads by using cloud-based tools or moving to a smaller office space, can drastically improve your cashflow standing.

Leveraging Technology to Manage Cashflow

Using accounting software and other financial technologies can automate and streamline cashflow management processes. These tools provide real-time insights and help business owners make informed financial decisions.

In today’s digital age, technology is your best ally in managing cashflow effectively. Accounting software like QuickBooks or Xero efficiently manages bookkeeping tasks and integrates seamlessly with your bank accounts. These systems provide up-to-date financial information, giving you a clear view of your business’s cashflow status at any time. Moreover, they can automate invoicing and payment reminders, reducing the risk of human error and the likelihood of delayed payments. Beyond basic accounting, various financial tech tools analyze spending habits, cashflow patterns, and offer predictive insights, which are invaluable for future business planning.

Embracing these technologies isn’t just about convenience—it’s about creating a more strategic business approach. Imagine having the ability to quickly adjust plans based on real-time data, to test multiple ‘what-if’ scenarios before making critical decisions. These technologies also provide the added benefit of storing your financial data securely in the cloud, allowing for easy access and collaboration with team members or external advisors, regardless of location. By investing in the right financial tools, startups can save time, reduce error margins, and focus their energies on innovation and growth.

Seeking Professional Advice for Financial Management

Consulting with financial advisors or accountants can provide valuable guidance for managing cashflow effectively. Their expertise helps in identifying potential risks and crafting strategies tailored to the unique needs of your startup.

The value of professional advice cannot be overstated—financial advisors bring a wealth of knowledge and experience that can be transformative for startups. They offer a third-party perspective that can reveal blind spots or opportunities you may have overlooked. Advisors can assist in cashflow forecasting, help establish efficient processes for financial management, and even provide peace of mind in knowing that your financial strategies align with industry best practices. Especially when facing complex financial challenges, having someone to consult can drastically change the trajectory of your business. By working with professionals, you can also ensure compliance with financial regulations, thereby avoiding any legal pitfalls that could further strain your resources.

Building a relationship with a trusted financial advisor or accountant is an investment in your business’s future. They can tailor advice to the specific needs of your startup, whether it be identifying potential cost-saving measures or exploring financing opportunities when cashflow is tight. Remember, it’s not just about solving immediate problems; it’s about longstanding partnerships that foster sustainable growth. As your business evolves, so too will your financial strategies, highlighting the need for ongoing professional guidance. Therefore, engaging with a financial expert sooner rather than later can put your startup on a path toward lasting success.

Empowering Your Startup for Financial Success

Effective cashflow management is not just about survival; it’s about empowering your startup to thrive. By understanding and implementing strategic cashflow practices, UK startups can ensure they have the resilience and resources needed to grow and succeed in an ever-competitive market.