Managing accounts receivable efficiently is crucial for businesses aiming to maintain healthy cash flow. In the UK, understanding the nuances of optimizing this process can significantly impact a company’s financial wellbeing. This guide will walk you through practical steps to enhance your accounts receivable management.

Understanding the Importance of Accounts Receivable

Accounts receivable is a vital component of the financial health of any business. It refers to the outstanding invoices a company has, or the money clients owe for goods or services. Managing this correctly ensures that a company can maintain a steady cash flow, crucial for operational success. In the UK, businesses face unique challenges with accounts receivable, including the unpredictability of client payments and the nuances of legal frameworks. Understanding how to navigate these waters can bolster a business’s financial standing, enabling it to thrive rather than just survive. As cash flow is often cited as the lifeblood of a business, mastering its inflow through timely accounts receivable can significantly aid in strategic planning and operational efficiency.

For those wanting to dive deeper into maintaining financial stability, understanding the broader commercial debt recovery process is key. This not only involves timely debt retrieval but also often requires a clear strategy surrounding credit control and accounts management. A well-organized accounts receivable process encourages healthy client relationships and can lead to more informed decision-making. Focusing on this aspect can also free up resources and enable businesses to invest in growth opportunities that align with their long-term strategic goals.

Evaluating Your Current Process

To optimize your accounts receivable, start by assessing your current process. Identify bottlenecks and delays in payments. Consider the software tools and systems you currently use and whether they align with best practices and current technologies. For instance, does your existing system integrate well with other facets of your financial operations? If not, it might be time to consider upgrades or adjustments.

A thorough evaluation will often reveal areas ripe for improvement and innovation. Are you using automated tools to streamline invoicing and reminders? Such features can drastically cut down on manual processes and reduce errors, propelling your accounts receivable process into a realm of efficiency that wasn’t possible a mere decade ago. Moreover, these tools offer valuable insights, providing analytics that highlight trends and payment patterns that fuel strategic planning and forecasting. Learn more about enhancing this aspect through our guide to credit management.

Implementing Clear Credit Policies

Clear credit policies help in setting expectations with clients. Outline terms and conditions before transactions and ensure they are communicated effectively to avoid misunderstandings. This step is essential for managing risks associated with credit sales.

When implementing credit policies, transparency is key. Clearly defining payment terms, interest on late payments, and other essential clauses should form the cornerstone of any agreement with clients. This level of clarity protects both parties and sets the groundwork for healthy financial interactions. Clients aware of your policies are more likely to honor agreed terms, thus keeping cash flow stable. Enforce your policies consistently; fluctuating terms can lead to accountability issues and cash flow disruption. For businesses struggling with these aspects, engaging with a debt recovery specialist might be advantageous as they can provide insights into robust credit governance.

Leveraging Technology for Efficiency

Technology can transform your accounts receivable process by streamlining workflows. Use accounting software that offers automation features such as automatic invoice generation and payment reminders. This reduces manual errors and saves time.

Integrating technology with your accounts receivable processes not only enhances efficiency but also maximizes your strategic capabilities. Implementing technology such as cloud-based solutions can provide real-time insight into your financial metrics, allowing for improved decision-making. Additionally, automating repetitive tasks, such as follow-up reminders for overdue payments, helps maintain relationships without exerting manual effort. Consider exploring how cloud-based solutions can enhance your business’s efficiency and overall financial health.

Effective Communication with Clients

Maintaining open communication channels with clients is crucial. Ensure timely follow-ups on overdue invoices and offer flexible payment plans if required. Good communication can improve client relationships and encourage timely payments. By consistently engaging with clients—whether through emails, phone calls, or meetings—you nurture a relationship built on trust and dependability. These interactions should focus not just on collection, but also on understanding client needs, which can pave the way for flexible solutions if payment issues arise.

Utilize communication tools to foster connections with clients. Crafting personalized messages rather than automated reminders can foster good relationships. Even when adopting an automated approach for efficiency, infuse personal touches that make your messages more engaging and less transactional. Proactive communication also allows you to address issues early, keeping your accounts receivable healthy and minimizing payment delays. Discover additional strategies in our short guide on managing unpaid invoices.

Regular Monitoring and Adjustments

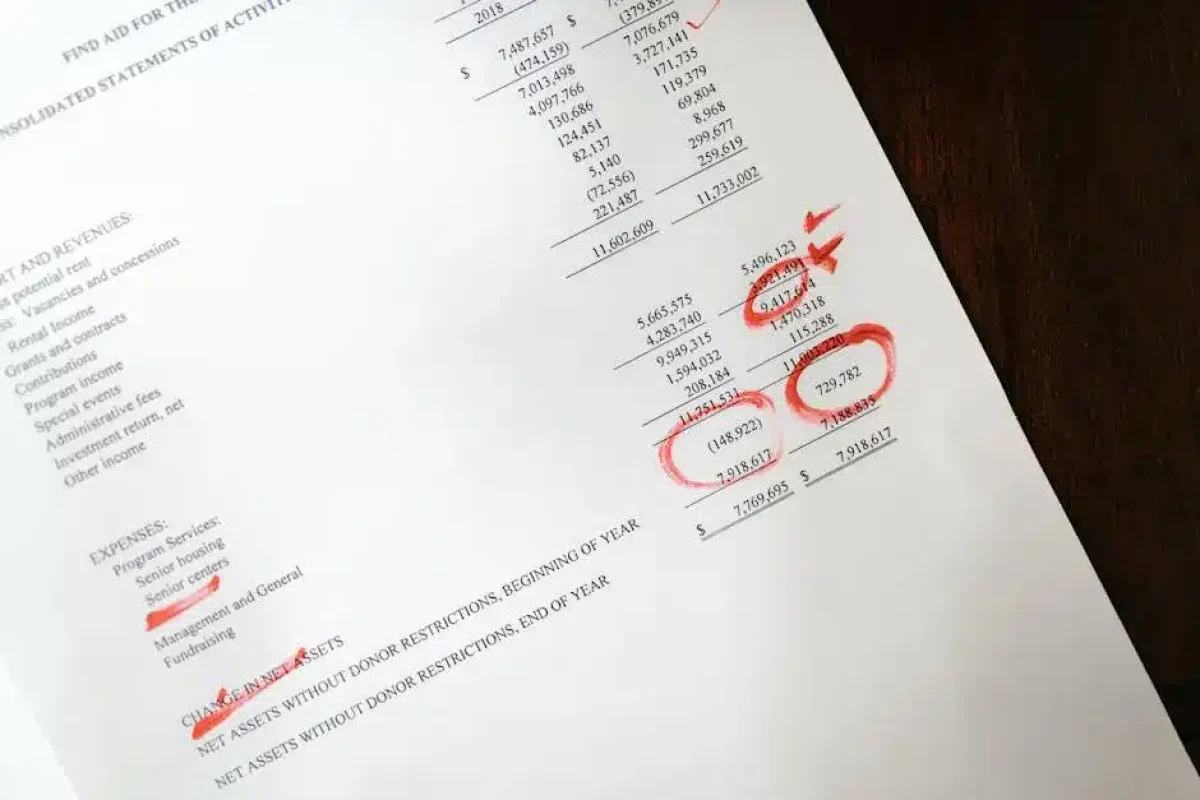

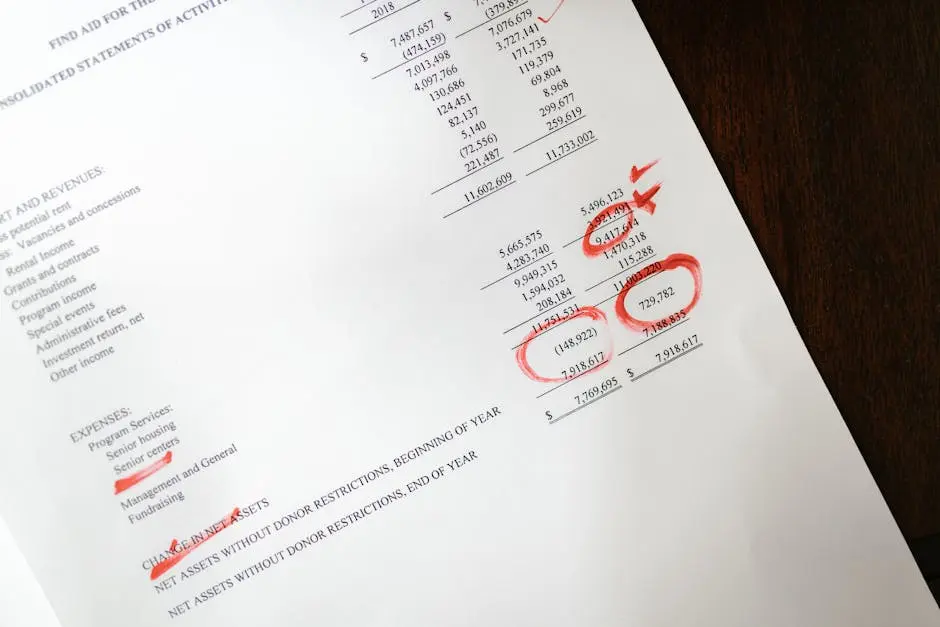

Optimize your process by regularly reviewing your accounts receivable metrics. Analyze key performance indicators (KPIs) such as average payment period and cash flow trends. Regular monitoring allows for timely adjustments to strategies for maximum efficiency.

Scheduling regular reviews can uncover trends and patterns that offer valuable insights into your accounts receivable processes. Monthly or quarterly assessments of KPIs like DSO (Days Sales Outstanding) and aging reports not only showcase current cash flow health, but reveal any emerging issues that need addressing. This proactive stance facilitates decision-making, ensuring that strategic adjustments can be made in a timely fashion to ward off potential cash flow challenges. For more tips on keeping your cashflow robust, check out our expert advice.

Streamline Your Operations and Enhance Cash Flow

Optimizing your accounts receivable process is not only about improving cash flow but also about fostering better relationships with your clients. By implementing these strategies, your business can benefit from a smoother, more predictable financial environment and free up resources to focus on growth and innovation. For more insights on how to improve your company’s financial health, visit our homepage.